The two most common types of property insurance claims in Florida are (1) windstorm (often, but not necessarily, caused by a hurricane) and (2) damages caused by water during a plumbing leak (“a sudden and accidental discharge of water”). In these types of cases, insurance policies give the insurance company the ability to argue that the damages were caused by “longterm wear and tear,” “neglect,” or “inadequate maintenance” and are, therefore, not covered.

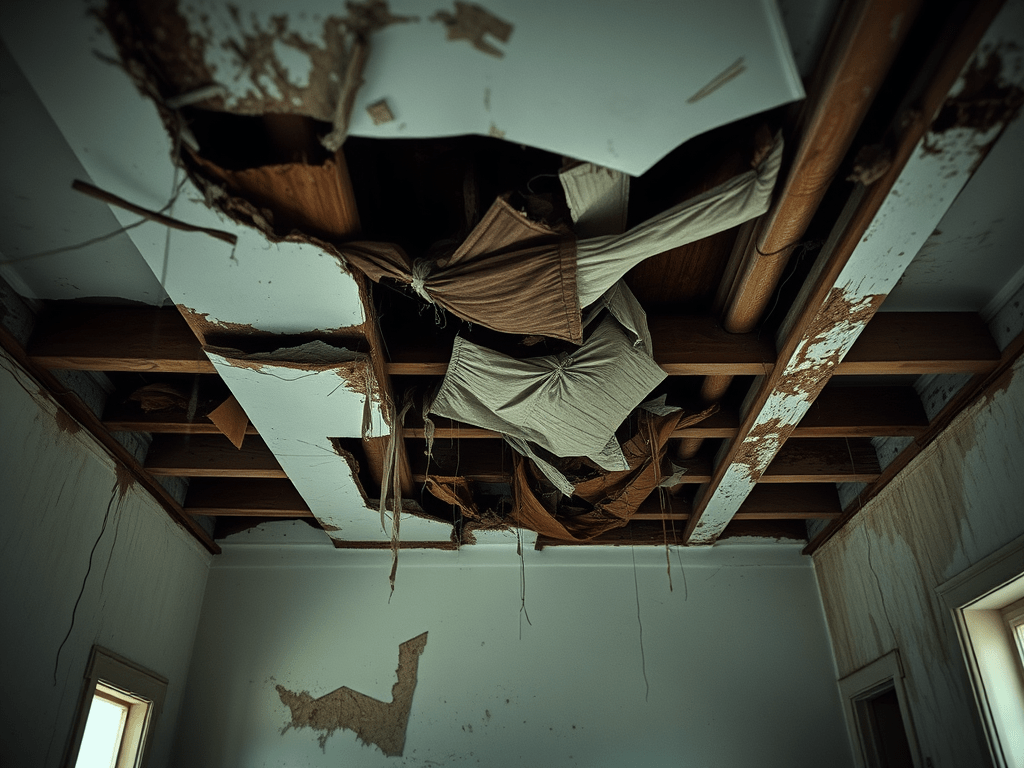

But what if a part of the building has collapsed? An often overlooked aspect of these cases is that if a part of the building suddenly collapsed, there is coverage for “collapse”–an “additional coverage” in the policy–even if the collapse was caused by longterm wear and tear (aka “decay”), if the decay was hidden and not know to the insured. If the collapse was sudden and was caused by the weight of rainwater or hidden and unknown “decay” (which, of course, is caused or allowed to exist by longterm wear and tear and/or lack of maintenance), then the damages are covered. The coverage for “collapse” in standard insurance policies is a separate, “additional coverage,” found in a separate section of the policy, in which “wear and tear” is not an exclusion. All that is required for coverage is that the “decay” was hidden and not known to the insured prior to the sudden collapse.

Take, for example, a claim that is originally reported by the insured to the insurance company as a claim based on damages caused by Tropical Storm Eta. Tropical Storm Eta slammed into South Florida on November 8, 2020 as a devastating storm with a lot of wind and a ton of rain, but the winds were not quite at hurricane level. For three years since the storm, insurance companies have argued, essentially, that Tropical Storm Eta was “not a big deal” because “it wasn’t a real hurricane.” Insurance companies, of course, do not quite articulate it that way, but that is what they want courts and juries to believe. Indeed, Tropical Storm Eta indisputably brought wind gusts of at least 60 mph to South Florida, and those winds were enough to cause direct damages to roofs. But what if the insurance company uses an engineer to say that the damages to your roof were not caused by the direct force of wind on November 8, 2020?

Did any part of your ceiling fall down? If so, you might have a “collapse” claim. Coverage under the sudden collapse “additional coverage” does not have to be tied to wind or a lack of longterm wear and tear or maintenance. If the collapse was sudden and caused by hidden and unknown decay (not known to the insured) or the weight or rainwater, you have an argument that there is coverage. All that is required is that the collapse happened suddenly. Unlike a windstorm claim, the insured is not required to prove that wind caused the collapse all by itself on a particular date of loss. You have an argument that tropical storm-force winds–and a lot of rain–were the “straw that broke the camel’s back” that caused the sudden collapse, even if the roof was not in mint condition when it fell down, and the court should allow you to make that argument to a jury.

The author of this blog recently represented a client in this situation. Tropical Storm Eta damaged the client’s home and caused covered damages for which Citizens Property Insurance Corporation refused to pay. Citizens argued that all of the damages at issue were caused by longterm wear and tear and/or “a lack of adequate maintenance. The insured had evidence that the direct force of wind caused at least some of the damages that were visible on the roof, but additionally, during the storm, a portion of the property’s soffit over the front porch suddenly collapsed, either from the weight of rain or hidden and unknown decay. This collapse created a second basis of coverage regarding which “longterm wear and tear” was not a proper defense.

From day one, Citizens, as insurance companies usually do, made the mistake of focusing only on the “peril-created opening” portion of the policy. Under that section of the policy, the insured must prove that “the direct force of wind” caused physical damages to the property, and that the damages at issue were not caused by longterm wear and tear. But it is clear that the part of the policy that is usually found in section 7 or section 8, regarding “collapse,” provides a separate and independent “additional” basis of coverage, and longterm wear and tear or “decay” does not preclude this coverage, if the decay was hidden and unknown. The jury must be allowed to find that either the weight of rain that accumulated or hidden and unknown decay caused a “collapse,” which created an “additional” coverage under this “additional coverage” section of the policy.

If there is a reasonable basis from which a jury could find collapse, courts should allow this evidence and instruct the jury about this “additional” collapse coverage.

THE “COLLAPSE” SECTION OF THE POLICY

Standard Florida insurance policies provides a separate, “additional” coverage for “collapse”, usually found in section 7 or 8, as follows:

If the insured property has suffered a collapse caused either by the weight of rain, insects or vermin, or hidden and unknown decay, then “longterm wear and tear” is not a defense to “collapse” coverage. The very nature of this type of damage is that it occurs over a period of time. The key issue is whether the “decay” (or insect or vermin) damage was hidden and not known to the insured.

A trial that focuses solely on whether there was a “wind-created opening,” which is what insurance companies want, would be an improper trial that is not fair to the insured. Proving a wind-created opening or direct wind damage to the roof is only one of the ways that insureds can be found by the jury to be the victors in insurance coverage cases.

The policies very clearly provide that “decay” (which is a synonym for “wear and tear”) (and a lack of maintenance could be a reason why “decay” was allowed to exist) can be the cause of covered damages for a sudden collapse, as long as the decay was hidden and unknown to the insured prior to the collapse. All that matters is that the collapse itself happened suddenly. Insureds do not need to prove that the collapse happened during a particular windstorm. The “collapse” claim is not tied to damages caused by wind. Unlike a claim based on solely windstorm or a sudden and accidental discharge of water from the plumbing system, the insured does not have to prove, in a “collapse” case, that there was no longterm wear and tear (“decay”), if the decay was hidden and unknown.

The author of this blog has been fighting with insurance companies on behalf of insureds on this issue for the last seven years. Until recently, it appears that many defense lawyers (and judges) simply had not even been aware of the “sudden collapse” section of these policies. These lawyers sometimes cannot wrap their heads around the idea that not every item of claimed damage has to be tied to a particular one-time wind event. There can be damages caused by a windstorm and there can be a collapse caused by hidden and unknown decay–a separate coverage under the policy to which “lack of maintenance” is not a proper defense.

Courts should include a jury instruction on the “collapse” section of the policy, which is an additional coverage for which “longterm wear and tear” is not an exclusion, when the facts merit it. All that is required is that a portion of the building has fallen down suddenly. That is enough for the judge to conclude that a reasonable jury could find in favor of the insured on the “collapse” coverage issue.