The Fourth District just reminded us—again—that an insured must provide the insurance company with prompt notice of a claim to have any prayer of winning in a lawsuit against the insurance company alleging a wrongful denial of coverage. In the last two years, the cases in which insurance companies have won on this issue have piled up. Further, prompt means “immediately after the damages should have been discovered.” The law is clear on this issue.

In Security First Ins. Co. v. Visca, 387 So. 3d 313 (Fla. 4th DCA 2024), following a jury trial, appellant, Security First Insurance Company (“Security”), appealed a final judgment entered in favor of the appellees, Linda and Silvio Visca (the “Viscas”) on their claim for breach of their property insurance contract. The Fourth District held that as a matter of law, the Viscas failed to give Security prompt notice of their loss under the terms of the policy. Accordingly, the appellate court reversed the final judgment and remanded for a new trial on the issue of whether the untimely notice prejudiced Security, which the jury did not reach in rendering its verdict.

The facts of the case were these:

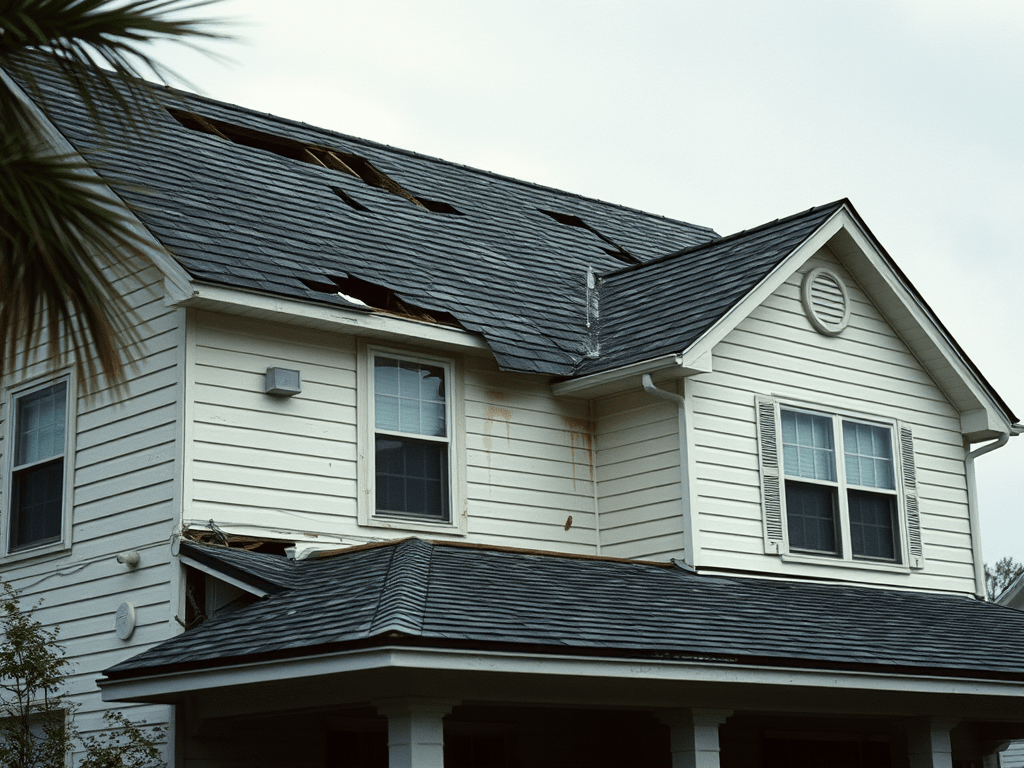

On September 10, 2017, Hurricane Irma made landfall, purportedly causing damage to the roof and water intrusion issues in the interior of the Viscas’ home. On February 20, 2020, about twenty-nine months later, the Viscas first notified Security of their loss by filing an insurance claim.

The policy stated that Security had no duty to provide coverage if the insureds’ “failure to comply with the following duties is prejudicial to us.” Among those duties, the policy required that, after a loss, the insureds “[g]ive prompt notice to [Security] or our agent.”

Security denied the claim, explaining that the policy excluded coverage because the damages resulted from wear and tear, not Hurricane Irma. The coverage letter did not cite untimely notice of loss as a basis for the denial. The Viscas sued for breach of the insurance contract. In its answer to the complaint, Security raised untimely notice of the loss as one of multiple affirmative defenses.

The matter proceeded to a jury trial, which centered on Security’s untimely notice defense, i.e., whether the Viscas gave prompt notice of their loss under the circumstances and, if the notice was untimely, whether the delay prejudiced Security’s investigation of the claim.

Mr. Visca’s uncontroverted trial testimony established the pertinent sequence of events. Mr. Visca testified that the home had no active roof leaks leading up to Hurricane Irma, and he did not notice any damage in the immediate aftermath of the storm. However, during Thanksgiving 2017, about two months after the storm made landfall, he first noticed water stains in the dining room. He went to the roof, removed some tile, and sealed a small opening above the affected area. He did not notify Security at that time because he “didn’t think it was enough damage to file a claim.“

Then, in late 2018, about a year after the leak appeared in the dining room, Mr. Visca discovered another leak in the nearby garage. Like before, he went to the roof and replaced a larger section of tile. Shortly thereafter, Mr. Visca spoke with his neighbor, a public adjuster, who inspected the roof. After their conversation, Mr. Visca authorized the public adjuster to handle an insurance claim on his behalf.

For reasons not clearly explained, the adjuster did not file Mr. Visca’s claim until February 20, 2020, over a year after their conversation and almost two-and-a-half years after the hurricane. Mr. Visca acknowledged that he did not otherwise notify Security of the damage in the meantime.

387 So. 3d at 315-16. Central to the appeal, at the close of the Viscas’ case, and at the close of the evidence, Security moved for a directed verdict on its untimely notice defense. In pertinent part, Security argued Mr. Visca’s testimony established that the Viscas failed to give prompt notice of their loss as a matter of law. The trial court denied Security’s motions, finding factual issues remained as to both prompt notice and prejudice.

Using a special verdict form, the jury rendered a verdict for the Viscas and found that the Viscas gave prompt notice of their loss. As a result, the jury did not decide whether Security was prejudiced by any delay in getting notice. Security renewed its motions for directed verdict and, in the alternative, moved for a new trial. The trial court denied Security’s post-trial motions. The insurance company appealed.

I. Security did not waive its untimely notice defense.

As a preliminary matter, the Viscas contended Security waived its untimely notice defense because it denied their claim under a policy exclusion, without raising untimely notice or prejudice in its coverage letter. The Fourth District disagreed, noting:

We have previously held that a property insurer did not waive an untimely notice defense by denying coverage on other grounds. See Stephenson v. Fed. Ins. Co.,764 So. 2d 936, 937 (Fla. 4th DCA 2000) (rejecting, after rehearing, the insured’s argument that “the insurers’ denial of coverage constituted a waiver of the right to assert prejudice because of late notice.”).

This is true because, by denying a claim based on a policy exclusion, a property insurer asserts that the claim falls entirely outside the policy’s scope. In that instance, the insurer’s conduct does not clearly demonstrate an intent to otherwise relinquish its contractual right to prompt notice of the loss, as necessary to support an implied waiver. See Am. Somax Ventures v. Touma, 547 So. 2d 1266, 1268 (Fla. 4th DCA 1989).

Phrased differently, although Security did not raise the issue of notice in its coverage letter, it timely and properly raised the defense early in the litigation. Therefore, its forbearance from initially making timely notice an issue for a reasonable time, without more, cannot constitute a waiver. See id.

Id. at 317.

II. As a matter of law, the Viscas failed to give “prompt notice” of their loss.

The Fourth District reminded us:

“[P]rompt and other comparable phrases, like immediate and as soon as practicable, do not require instantaneous notice.” Laquer v. Citizens Prop. Ins., 167 So. 3d 470, 474 (Fla. 3d DCA 2015) (internal quotation marks omitted) (quoting Cont’l Cas. Co. v. Shoffstall, 198 So. 2d 654, 656 (Fla. 2d DCA 1967)). Rather, Florida courts have interpreted such phrases to mean that notice should be provided “with reasonable dispatch and within a reasonable time.” Id. (quoting 318*318Yacht Club on the Intracoastal Condo. Ass’n v. Lexington Ins. Co., 599 F. App’x 875, 879 (11th Cir. 2015)).

Accordingly, what constitutes prompt notice under an insurance policy often depends upon the surrounding circumstances. LoBello v. State Farm Fla. Ins., 152 So. 3d 595, 599 (Fla. 2d DCA 2014) (quoting Renuart-Bailey-Cheely Lumber & Supply Co. v. Phoenix of Hartford Ins. Co., 474 F.2d 555, 557 (5th Cir. 1972)). However, “if the undisputed evidence will not support a finding that the insured gave notice to the insurer as soon as practicable,” then the court may decide the issue as a matter of law. Id. at 600 (first citing Ideal Mut. Ins. Co. v. Waldrep, 400 So. 2d 782, 785 (Fla. 3d DCA 1981); then citing Midland Nat’l Ins. Co. v. Watson,188 So. 2d 403, 405 (Fla. 3d DCA 1966); and then citing Clena Invs., Inc. v. XL Specialty Ins. Co, 2012 WL 1004851, at *4 (S.D. Fla. March 26, 2012)).

Notice is prompt:

… if it is given within a reasonable time of the event triggering the insured’s duty to notify. Cordero v. Fla. Ins. Guar. Ass’n, 354 So. 3d 1150, 1153 (Fla. 2d DCA 2023) (citing Laquer, 167 So. 3d at 474). The duty to notify is triggered “when a reasonable person, viewing all available facts and information, would conclude that an award implicating the policy is likely.” Id. (quoting LoBello,152 So. 3d at 599). Stated another way, notice is necessary “when there has been an occurrence that should lead a reasonable and prudent [person] to believe that a claim for damages would arise.” Laquer, 167 So. 3d at 474 (alteration in original) (quoting Waldrep, 400 So. 2d at 785).

Id. at 318. Notably, said the Fourth District, the duty to notify is not per se triggered when the loss initially occurs, or when the insured first discovers damage to their property. See id. at 474; Cordero,354 So. 3d at 1154.

However:

… in a case like this where an insured allegedly sustained property damage due to a hurricane, Florida courts have often found that the insured’s initial discovery of that damage triggered the duty to notify, at least when the damage first appeared shortly after the storm. These cases are equally clear that a subsequent delay in notice is not excused simply because the insured believed the damage was not severe enough to justify filing a claim. See 1500 Coral Towers Condo. Ass’n. v. Citizens Prop. Ins., 112 So. 3d 541, 543 (Fla. 3d DCA 2013) (holding notice was not prompt as a matter of law where the insured first discovered damage to the property’s roof only one month after a hurricane but delayed notifying its insurer because it believed the damage would not exceed the deductible); Kramer v. State Farm Fla. Ins., 95 So. 3d 303, 305 (Fla. 4th DCA 2012) (rejecting insureds’ argument that they were not required to give notice of a loss sustained in a hurricane “until they knew that the loss was above their deductible.”); Tamiami Condo. Warehouse Plaza Ass’n. v. Markel Am. Ins., 19-CV-21289, 2020 WL 1692177, at *2 (S.D. Fla. Feb. 24, 2020) (holding seven-month delay in notifying insurer was untimely as a matter of law where insured “was aware of damage caused by Hurricane Irma in close proximity to the time of the occurrence of Hurricane Irma”).

Id.

In Perez v. Citizens Property Insurance Corp., 345 So. 3d 893 (Fla. 4th DCA 2022), the trial court granted summary judgment for the insurer, finding no genuine issue of fact that the insureds failed to comply with their post-loss duties of prompt notification for failing to submit a damage claim for more than one year following Hurricane Irma, resulting in prejudice to the insurer. Id. at 895. In that case, it was undisputed that the insureds had notice of damage but did not report it until fourteen months after the date of loss. Id. Accordingly, the Fourth District affirmed summary judgment as to prompt notice because the insureds did not establish the date that they first became aware of the damage, nor the date that their tenant informed them of the damage. Id. Therefore, the insureds failed to make a showing sufficient to establish the existence of prompt notice, an “element essential to [their] case, and on which [they] will bear the burden of proof at trial.” Id. at 896 (quoting Jones v. UPS Ground Freight, 683 F.3d 1283, 1292 (11th Cir. 2012)).

However, the Fourth District in Perez reversed and remanded to the lower court because a factual issue remained as to whether the insurer was prejudiced by the untimely notice. Id. Relying on Arguello v. People’s Trust Insurance Co., 315 So. 3d 35 (Fla. 4th DCA 2021), the appellate court wrote that an insured’s “failure to comply with policy conditions requires prejudice to insurer in order for that failure to constitute a material breach and permit an insurer to deny coverage for a claim. Whether insurer is prejudiced is a question of fact.” Perez, 345 So. 3d at 896; cf. Arce v. Citizens Prop. Ins. Corp., 49 Fla. L. Weekly D79, ___ So.3d ___ (Fla. 3d DCA Jan. 3, 2024) (summary judgment affirmed where evidence plainly established that insureds’ notice to insurer three years after Hurricane Irma was not prompt, and that the delay resulted in prejudice to the insurer).

But, said the Fourth District:

… where the insured produces evidence that, based on other circumstances, they had reason to doubt whether the damage resulted from a covered peril, courts have found a genuine dispute of fact regarding when the duty to notify arose, and whether notice was thereafter promptly given.

For example, in Bensen v. Privilege Underwriters Reciprocal Exchange, 48 Fla. L. Weekly D1085, ___ So.3d ___ (Fla. 6th DCA May 26, 2023), the insured produced evidence that (1) the property’s roof damage did not appear until approximately eighteen months after Hurricane Irma, and (2) multiple roofing experts, including the insurer’s own adjuster, preliminarily inspected the roof, finding the damage was not related to the storm. Id. at ___, 48 Fla. L. Weekly D1085 at D1085. The insured further showed that he notified his insurer of his claim only five days after he had first learned that the damage could have been storm related. Id. The trial court granted summary judgment for the insurer on the issue of prompt notice. Id.

On appeal, the Sixth District found a factual dispute existed as to whether the insured’s duty to notify arose when he first discovered the roof damage because “there was disputed evidence regarding whether a reasonable person in [the insured’s] position would have concluded that he had a claim under his insurance policy any time significantly earlier than when [the insured] gave notice to [the insurer] of the claim.” Id. at ___, 48 Fla. L. Weekly D1085 at D1086.

Id. at 319. Similarly, in Laquer, a hurricane struck the insured’s condo unit while a tenant occupied the property. Laquer, 167 So. 3d at 472. As time passed, neither the condominium manager, a housekeeper, nor other agents of the condominium who regularly visited the unit observed any signs of damage for several years. Id. The tenant also did not report any damage. Id. Nearly three years after the storm, the insured visited the unit for the first time, discovering that wood flooring in the unit had warped due to water damage without the water’s source being determinable. Id. at 472-73. The insured then spoke with the condominium manager, who responded that the hurricane likely had caused the water intrusion. Id. at 473. Shortly thereafter, the insured filed an insurance claim. Id.

The Third District found questions of material fact existed as to when the insured’s duty to provide notice of the loss arose. Id. at 474 (citing LoBello, 152 So. 3d at 601-02). In so holding, the court distinguished those cases where an insured first discovers damage to their property shortly after a hurricane:

In the context of hurricane damage claims, courts have upheld summary judgment on the insured’s failure to provide “prompt” notice where the insured was aware of damage to the residence shortly after the hurricane, but, for a variety of reasons, waited until several years passed before notifying the insurance company.

Based on the summary judgment record before us, however, damage to [the insured’s] unit or the interior of the wall was not apparent until several years after Hurricane Wilma: no one … was able to observe any damage to the wood flooring or walls of the unit … or was otherwise put on notice to further inspect for damage.

Id. (citations omitted).

In contrast to Bensen and Laquer, said the Fourth District, the Viscas’ experience fell within the line of cases where no disputed issues of fact existed, i.e., the Viscas were “aware of damage to the residence shortly after the hurricane, but, for a variety of reasons, waited until several years passed before notifying the insurance company.” Id. The Fourth District reasoned:

At trial, Mr. Visca acknowledged that his home had no active roof leaks leading up to Hurricane Irma, and he personally observed a water leak and some damage to his roof during Thanksgiving 2017, only two months after the storm. He then went to the roof, removed some tile, and sealed a small opening above the affected area. We take no position on whether this event was sufficient to trigger the Viscas’ duty under the policy to provide prompt notice, as this is not dispositive of the issue before us.

However, Mr. Visca further testified that, after he found a second roof leak in late 2018, he retained a public adjuster to pursue an insurance claim on his behalf. For various reasons, the adjuster did not file the claim until February 2020. Mr. Visca conceded that, in the meantime, he had failed to otherwise notify Security of the loss, as was his duty under the policy at issue.

In sum, said the Fourth District:

… because Mr. Visca’s duty to notify was triggered upon his discovery of the roof damage in 2018, and he concededly failed to provide notice until February 2020, well over a year later, notice was not prompt as a matter of law, and Security was entitled to a directed verdict on that discrete issue. See Perez, 345 So. 3d at 896 (affirming summary judgment against insured as to prompt notice; finding notice delayed by fourteen months was not prompt as a matter of law).

Because the jury did not reach the issue of prejudice in rendering its verdict, it remained to be decided whether the Viscas’ untimely notice of their loss resulted in prejudice to the insurer. Accordingly, the Fourth District reversed the final judgment and remanded for a new trial on whether the Viscas’ untimely notice prejudiced Security.