The Florida Third District Court of Appeal’s January 7, 2026 decision in Security First Insurance Company v. Moreno is a stark reminder that “prompt notice” provisions in property insurance policies still matter—and can undo a jury verdict after trial.

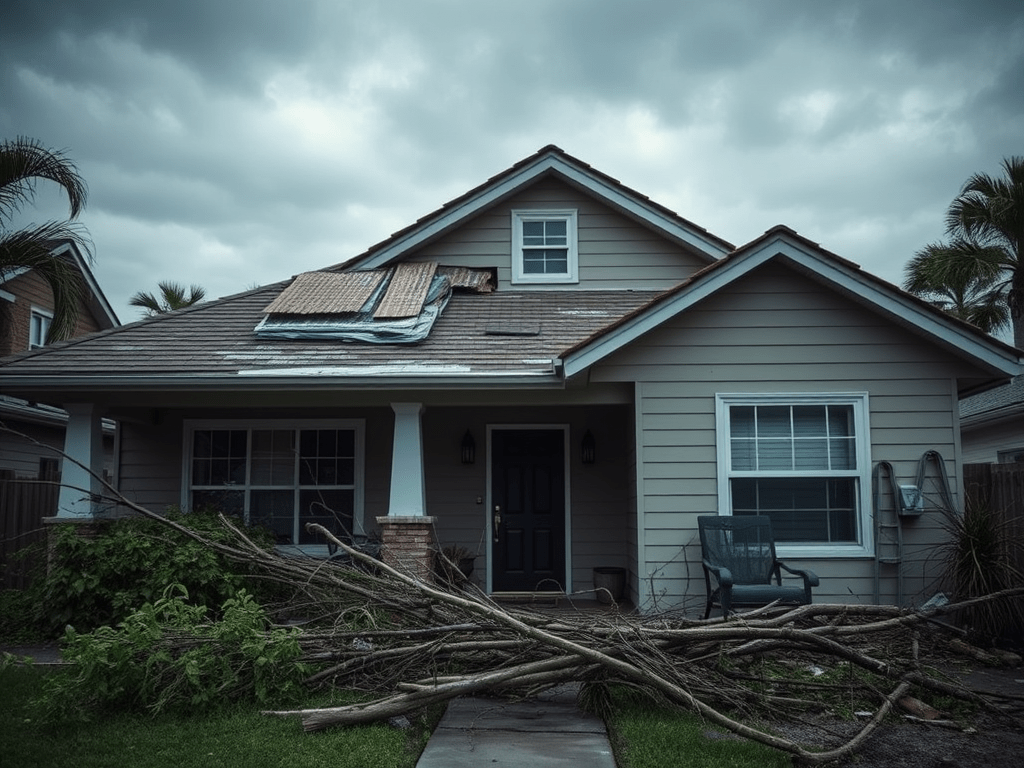

This was a first-party Hurricane Irma case. The homeowners noticed roof damage shortly after the storm and observed interior water staining within two months. The stains worsened over time, additional staining appeared, and water intrusion continued during later wind events. Despite this, the insureds did not report the loss to their carrier until April 2020—more than two and a half years later. The reason given was personal and family issues.

At trial, the jury found in favor of the insureds. It concluded the damage was caused by Hurricane Irma, rejected the insurer’s exclusion defenses (wear and tear, defective construction, lack of maintenance), and awarded damages. Critically, the jury also found that the insurer failed to prove the insureds did not give “prompt notice,” which meant the jury never reached the prejudice question.

The Third DCA reversed.

Prompt Notice Is Usually a Fact Question—Until It Isn’t

Florida law generally treats prompt notice as a jury issue, defined as notice given “with reasonable dispatch and within a reasonable time in view of all the facts and circumstances.” But the court emphasized that there are limits.

Here, the evidence was undisputed:

- The insured observed water damage two months after the storm.

- The damage worsened over time.

- New damage appeared months later.

- Water intrusion continued during subsequent wind events.

- The insured waited over two years to report the claim.

On those facts, the court held that no reasonable jury could find the notice was prompt. As a matter of law, the trial court should have directed a verdict for the insurer on the notice issue.

In other words, once an insured knows (or should know) they have a claim—and especially when damage is ongoing—delay is fatal unless legally justified.

Prejudice Still Matters—And That’s What Gets Tried Next

Importantly, late notice alone does not automatically bar coverage. Florida applies a two-step analysis:

- Was notice untimely?

- If so, was the insurer prejudiced?

Because the jury never reached the second step, the Third DCA remanded for a new trial limited solely to prejudice. If the insureds cannot rebut the presumption of prejudice, coverage is forfeited entirely. If they can, the original damages verdict gets reinstated.

Why This Case Matters

For insurers and defense counsel, Moreno reinforces that directed verdicts remain viable in extreme late-notice cases—even after a full trial and jury verdict.

For policyholder lawyers, it is a cautionary tale: sympathetic facts, credible experts, and favorable causation findings cannot save a case where the notice delay is extreme and unexplained.

And for insureds, the lesson is blunt: once you see damage that could reasonably lead to a claim, the clock is ticking. Personal issues may be understandable, but they are not legally sufficient to excuse years of delay.

Late notice is not a technicality. In Florida property insurance litigation, it can be case-dispositive—even after you “win” at trial.