The Florida Insurance Law Blog

By Jeffrey T. Donner, Esq.

Call 407-639-4223 to schedule a consultation with Attorney Jeff Donner today.

-

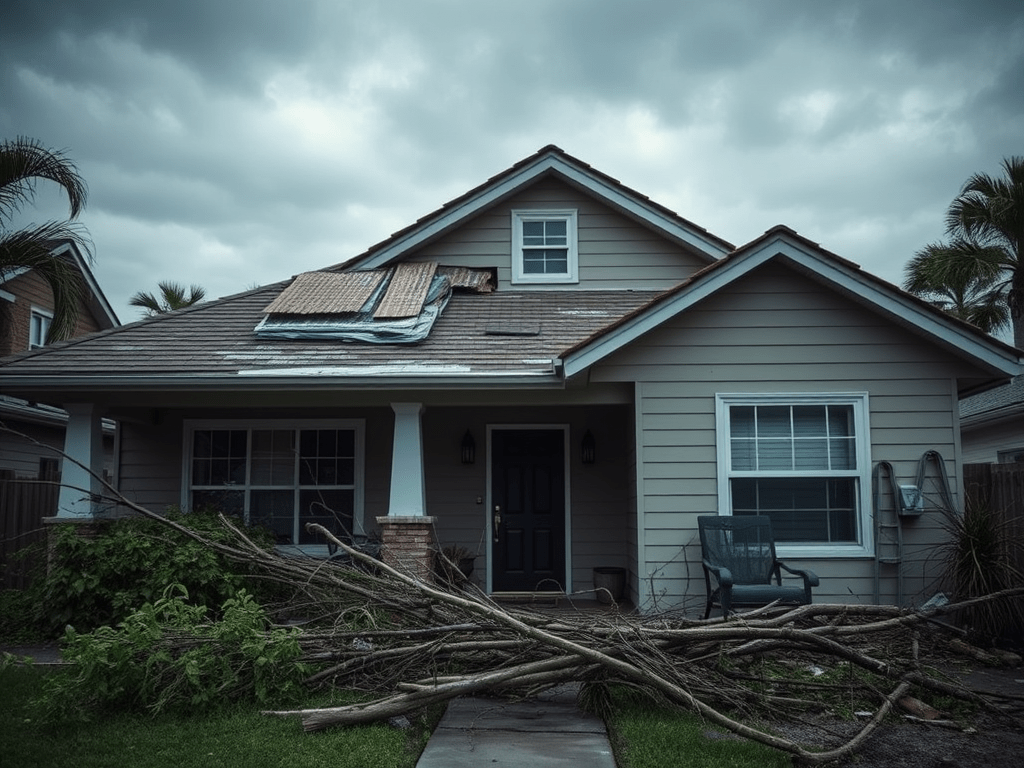

In January 2026, Florida’s Third District Court of Appeal issued a significant decision for hurricane-loss litigation: Kapson v. Homeowners Choice Property & Casualty Insurance Company, Case No. 3D24-0363. The case arose from Hurricane Irma, but its implications reach far beyond any single storm. For homeowners, insurers, and commercial policyholders navigating complex property losses involving multiple…

-

In January 2026, Florida’s Third District Court of Appeal issued an important—and very practical—decision in Rodriguez v. Bryant Permit Service, Case No. 3D25-0308. The case is a reminder that while trial courts must manage crowded dockets, dismissal of a lawsuit remains the most severe sanction available—and it cannot be imposed lightly, especially when the client…

-

Domestic violence injunctions are powerful. They can immediately cut off a parent’s contact with a child, override existing time-sharing arrangements, and dramatically alter the balance of power in an already tense family situation. Because of that power, Florida law sets a clear threshold for when an injunction is allowed. A recent decision from Florida’s Sixth…

-

At first glance, Harris v. Harris looks unremarkable. The appellate court affirmed the trial court’s decision in a single paragraph. No explanation. No analysis. Just “affirmed.” For most people, that would be the end of the story. But buried beneath that brief ruling is a lengthy dissent by one judge—and that dissent tells a very…

-

I. Introduction For many clients, the most uncomfortable aspect of hiring a lawyer is not discussing the facts of their case, but understanding how legal fees work. This discomfort is understandable. Legal services are intangible, outcomes are uncertain, and litigation often arises during stressful moments in a client’s life or business. Yet attorney fee arrangements…

-

In January 2026, Florida’s Third District Court of Appeal issued a decision that should be required reading for anyone negotiating—or trying to undo—a marital settlement agreement: Paniry v. Paniry, Case No. 3D25-2107. The opinion is not flashy, but it is important. It draws a firm line between legitimate fraud claims and post-judgment fishing expeditions, and…

-

Divorces and breakups do not always stay in family court. When accusations escalate—abuse, stalking, threats, addiction, or criminal conduct—it is increasingly common for disputes to spill into civil court. What begins as a personal relationship breakdown can quickly become a lawsuit involving claims for assault, defamation, or emotional distress, with very real financial consequences. A…

-

Most people understand, at least intuitively, why divorces are ugly. Two people once aligned now disagree about money, control, blame, and the future. Emotions run hot. Facts are disputed. Motives are questioned. What many business owners do not understand—until it is too late—is that a “business divorce” between partners can be even worse. When small…

-

The Florida Third District Court of Appeal’s January 7, 2026 decision in Security First Insurance Company v. Moreno is a stark reminder that “prompt notice” provisions in property insurance policies still matter—and can undo a jury verdict after trial. This was a first-party Hurricane Irma case. The homeowners noticed roof damage shortly after the storm and observed interior…

-

The Third District’s recent decision in A.B. v. Department of Children and Families (Fla. 3d DCA Jan. 14, 2026) is a clear reminder of a hard but settled principle in Florida dependency law: parental rights are fundamental, but they are not abstract, and they are not preserved by biology alone. The case affirms the termination…

You must be logged in to post a comment.